So in my last post, I mentioned how I began exploring how to find cheaper airplane tickets to Japan. What I found was that 8 out of 10 google articles was about the ‘travel hack’ of credit card mile points. People like Scott Keyes, Nomadic Matt, and several others have become famous for being able to travel around the world with this hack. To me this was anathema. Why was this? Because I already have a lot of credit card debt and have absolutely no interest in adding more.

The Nerdwallet has an excellent article on just how bad the credit card debt problem is becoming. The average American household owes $15,762 to credit card companies and as of 2015 39% of households carry revolving credit card debt. In total 80% of America are in debt for various reasons. This idea of using credit cards to give yourself an advantage has some merit, but it is something that requires a lot of self-discipline. Otherwise, you will have mired yourself in more debt and destroy the very reason you got the card in the first place.

Recently I explored getting a personal loan to pay off my credit card debt and the banker I talked to told me I had a very common problem. She went on to tell me that a misconception people have about credit cards is that it is income, but it is not income and for every transaction you make with one, you should double it your mind. What she meant by that was a credit card wasn’t like a job, where your get paid and instead it was borrowing money that you didn’t have. Doubling the amount actually charged was a simple technique used to make you think about what you are doing. After all, you wouldn’t be charging it on your card if you could afford it normally.

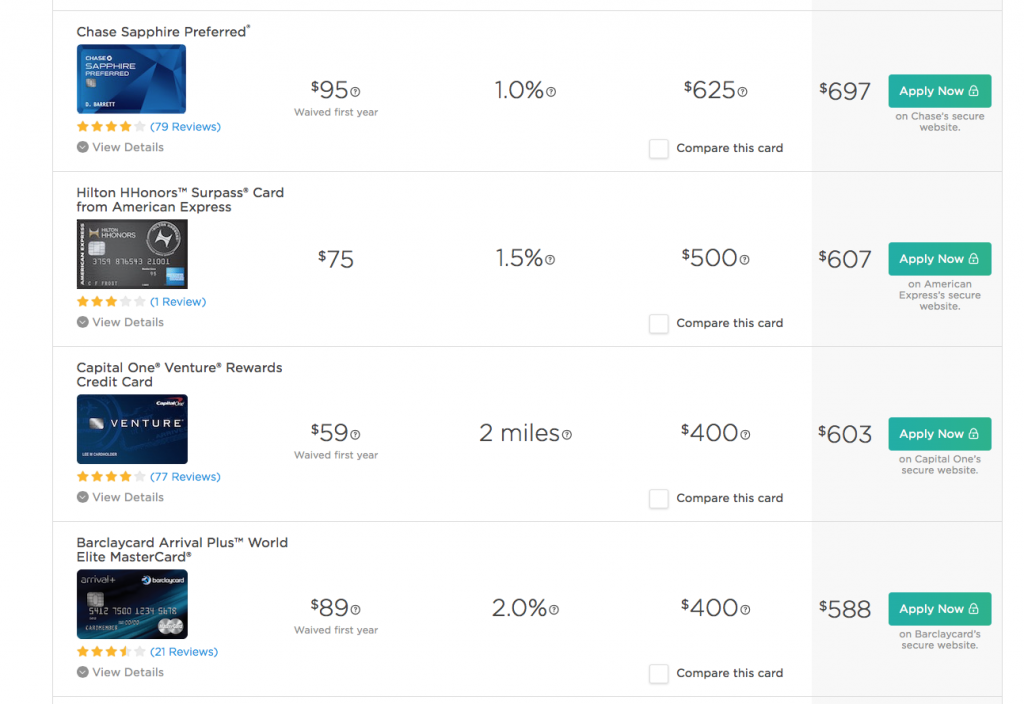

Chase Sapphire Preferred, Discover it Miles, Capital One Venture Rewards Credit Card, BankAmericard Travel Rewards Credit Card, Barclaycard Arrival Plus World Elite MasterCard are just some of the top cards out there in this category. In general, each of them offers a bonus if you meet certain criteria and are the most common reason people get these credit cards. Usually, 100 points = $1(except for Chase which offers a 25% bonus if you redeem through their reward program) Let’s examine a typical card in this category.

Capital One Venture Rewards Credit Card is, at the time of this post, offering 40,000 miles if you spend $3000 in 90 days. It offers a very good 2X points for every dollar spent. The miles don’t expire, no foreign transaction fee, a low annual fee of $59. APR: 13.24%-23.24%. It is also one of the most flexible reward programs out there. It allows you to book through your discount sites and fly on the airline of your choice, thus making it a perfect choice for the bargain hunter.

Let’s say you succeeded in getting the bonus. You spent $3000, got 6000 points from it and another 40,000 for hitting the bonus. 46,000 points=$460 in rewards. You’re looking very good, but the problem is did you strain your budget for it? Did you carry a balance on it from month to month? Did you pay it off every month? If you did carry a balance, if did you strain your budget to do this, then your rewards are not near as valuable as you think. Within the coming months, when you struggle to pay it off, that $460 bonus will shrink to down to nothing, then if you still haven’t paid it off, you will have gone into red and actually lost money by doing this. There is a reason why the banks still continue to offer these great deals on travel cards and that is because they make a large profit from them.

I am not saying don’t do it because it is possible to use this system for your own gain, but the people doing this don’t emphasize the potential problems with this enough. In fact, on the business insider article about Scott Keyes, there was a website called Award Wallet that was recommended for keeping track off all your credit cards and awards. Think about that for a second, he is juggling so many credit cards that he needs a program to help him keep track of everything. One simple way to tell if you can actually afford this type of ‘travel hack’ is to create a budget. Go to your bank account, look up 3 months of data, eliminate all items that you couldn’t use a credit card to pay for and then total it up. If its ≥ the bonus threshold and you believe you are disciplined enough, then you can pull it off. To make things slightly easier on yourself I would also recommend you take your debit bank card from your wallet and sock it somewhere safe when trying to rack up the bonus points.

Next time on the internet otaku, Adventuring with Japanese Hotels.